Featured

Feb 25, 2026

Product

You can now swap tokens on Velora using your Ledger hardware wallet, directly inside app.velora.xyz.

No separate Velora app.

No new installation.

Just connect your Ledger and trade with Clear Signing and Transaction Check enabled.

Velora handles execution.

Ledger secures your private keys.

This brings secure, self-custody DeFi trading to Velora’s execution layer — without changing your workflow.

Why Ledger + Velora Matters for Secure DeFi Trading

Hardware wallets are the gold standard for self-custody.

But many DeFi platforms still rely on blind signing or opaque smart contract approvals.

With Ledger connected to Velora:

Transactions are verified on-device through Clear Signing

Ledger displays the exact assets and amounts before you approve

Transaction Check protects against malicious contract interactions

Private keys never leave your hardware wallet

Velora’s Delta execution layer routes and settles swaps onchain.

Ledger ensures you sign only what you verified.

This separation — execution layer + secure signature layer — reduces risk without reducing speed.

How to Swap Tokens with Ledger on Velora

Everything happens inside the Velora web app.

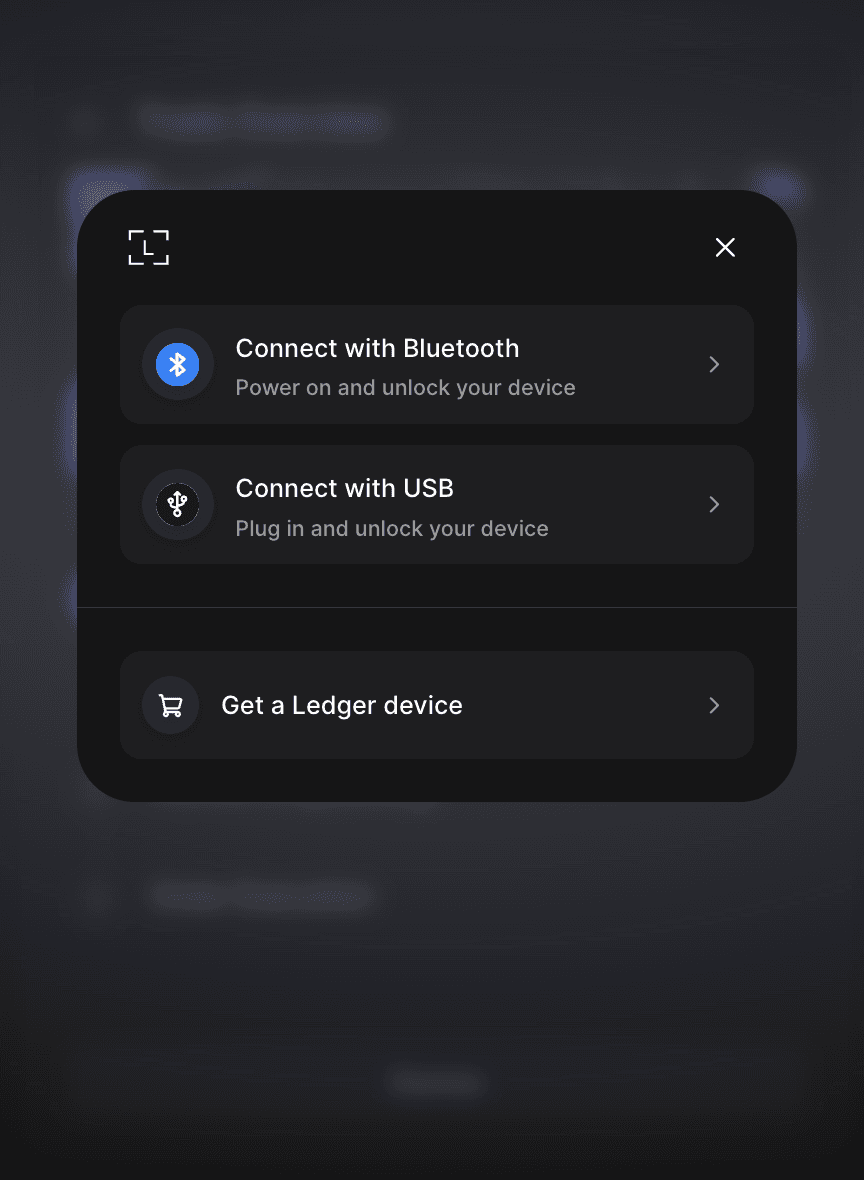

1. Connect Your Ledger Wallet

Open app.velora.xyz

Click Connect Wallet

Select Ledger Wallet

Connect via Bluetooth or USB

Choose your Ethereum account

You remain inside Velora while Ledger handles authentication and signing.

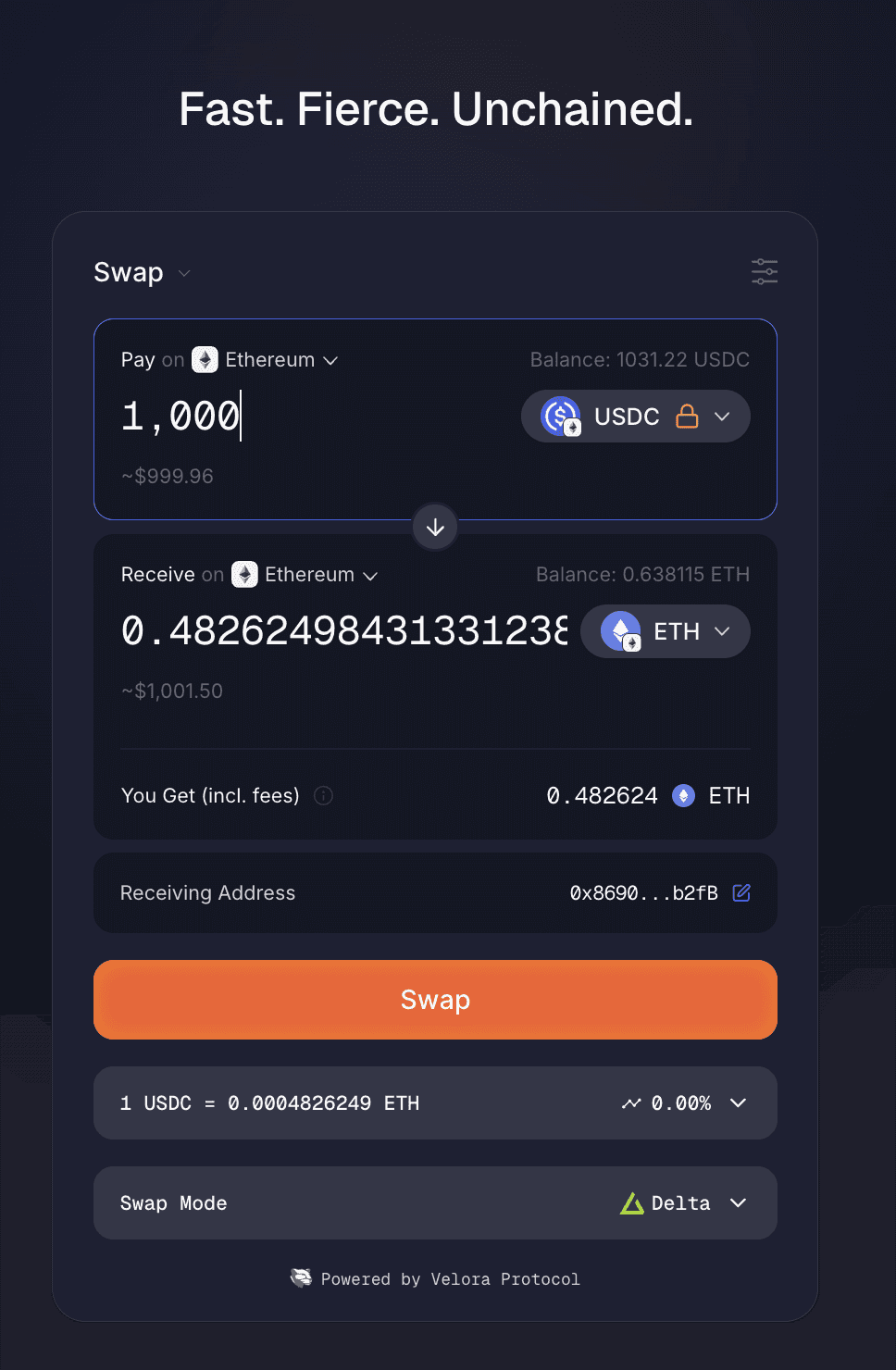

2. Create Your Swap

Select your tokens (e.g., USDC → ETH).

Enter the amount.

Review pricing and fees.

When you click Swap, your Ledger device displays the transaction details for verification.

No blind signing.

No hidden calldata.

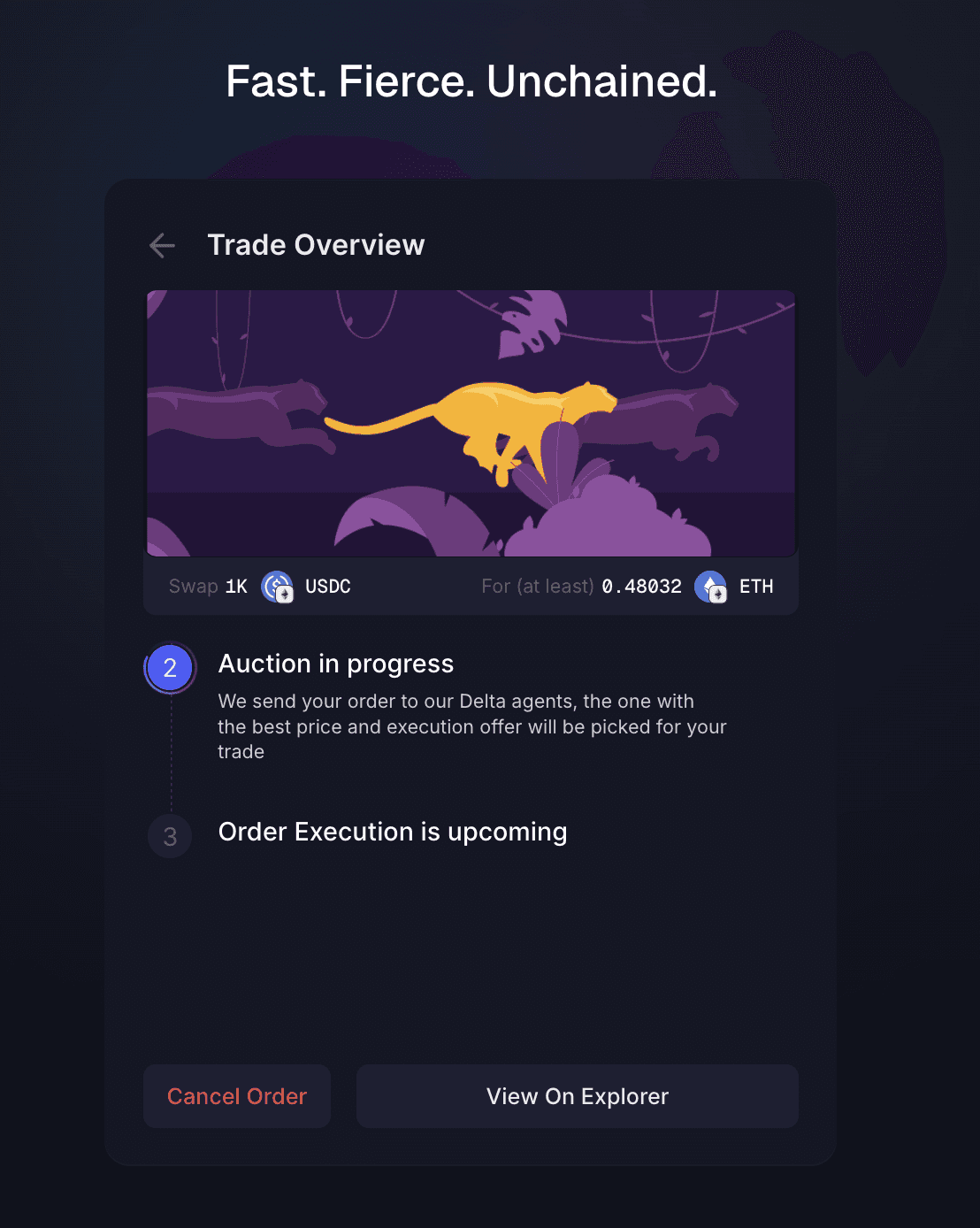

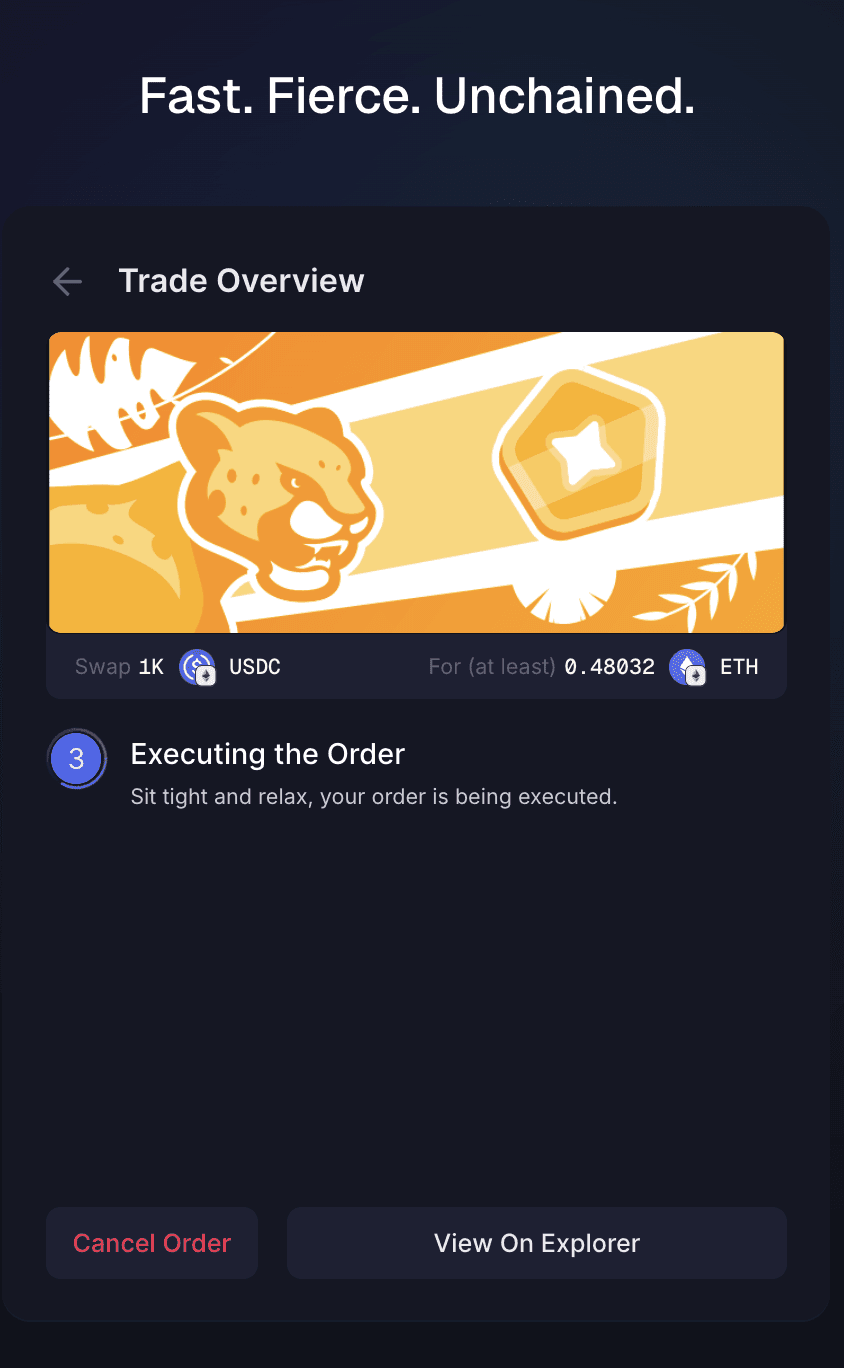

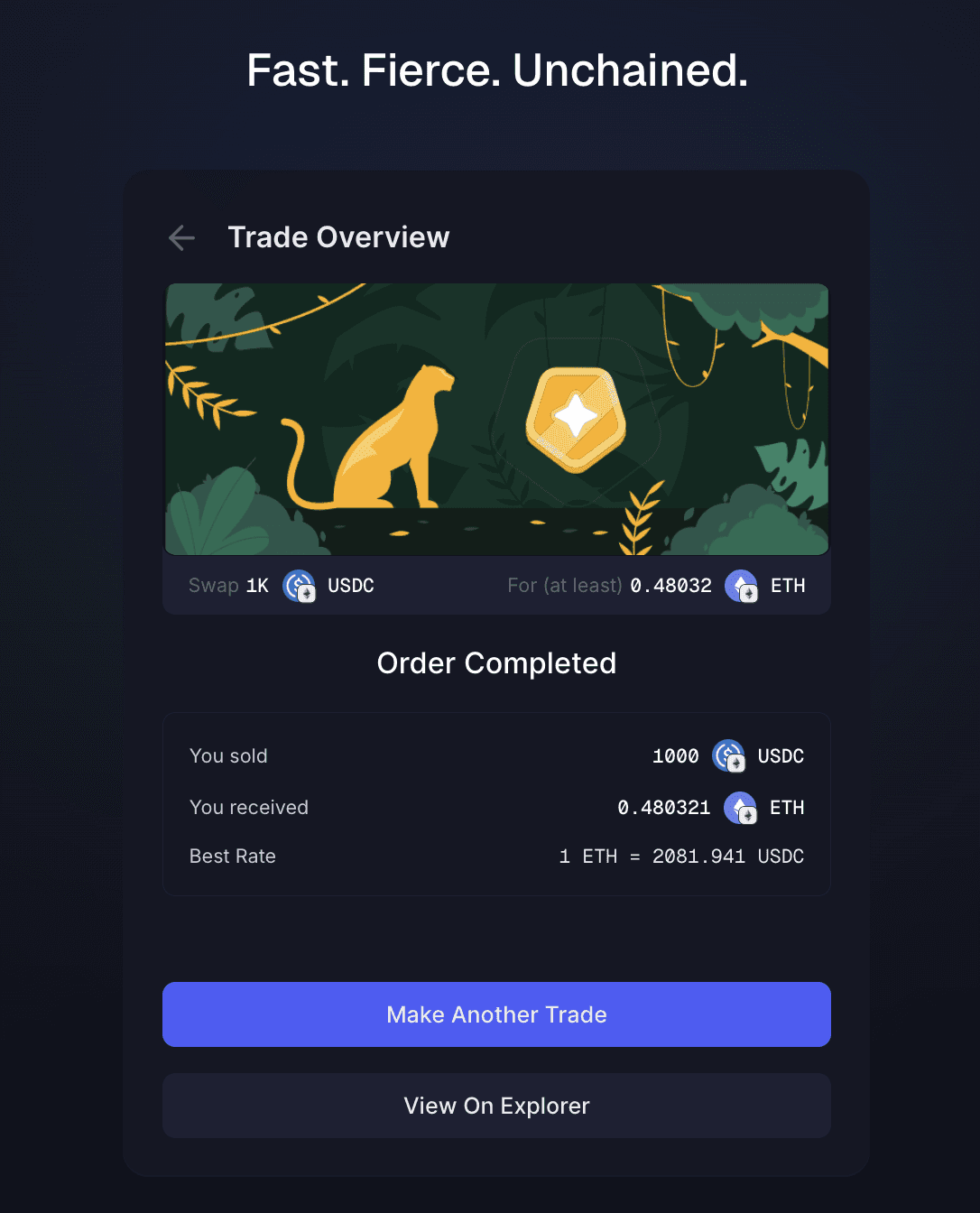

3. Delta Execution and Onchain Settlement

Once completed, you can see:

Tokens sold and received

Final execution rate

Confirmation status

Every swap is verifiable.

Inspect Transactions on Velora Explorer

Velora provides full transparency into every executed order.

Visit explorer.velora.xyz to:

Track Delta Orders

View transaction hashes

Inspect onchain settlement

Review execution history

If you use a hardware wallet for DeFi trading, visibility matters. Velora makes it native.

Frequently Asked Questions

Do I need to install a Velora app to use Ledger?

No. Ledger Wallet connects directly inside app.velora.xyz. All trading happens in the browser.

Does Velora support Ledger Clear Signing?

Yes. Transactions are verified on-device using Ledger’s Clear Signing and Transaction Check before approval.

Can I use my Ledger hardware wallet for crosschain swaps?

Yes. Velora’s Delta execution layer handles routing and settlement, while Ledger secures the transaction signature.

Are my private keys exposed when trading on Velora?

No. Private keys remain inside your Ledger hardware wallet at all times.

Benefits of Using Ledger Hardware Wallet on Velora

Velora is the execution layer for modern DeFi trading.

Ledger is the hardware wallet securing your private keys.

Together, that means:

Secure DeFi swaps

On-device transaction verification

No blind approvals

Fully onchain settlement

Transparent order tracking via Velora Explorer

Connect your Ledger and start swapping securely at app.velora.xyz